I have been in business for five years and in all those years, I would line up for at least half a day at the bank to pay my taxes. It’s the worst part of being in business, to be honest. I mean, I love working on my business, but I hate that I have to spend so much time just to pay my taxes. It’s precious time wasted, to be honest. And, not to mention, unnecessary stress to moms like me who usually bring my kids with me on errands. Thankfully, there are now apps like GCASH. It’s been around for a while, but I never thought it has the option to let its users pay BIR using the GCASH app.

You guys, this is a game-changer. You just need to file your taxes via the eBIR platform then head over to the app to pay. With just a few taps, you’re done! No more lining up for hours!

Before anything else, here are some things to take note of when You pay BIR via GCash:

- Form Series – You can the correct form series through the dropdown in GCash. If you are not sure which one to pick, click here to check my list of Form Series, Form Numbers, and Tax Types.

- Return Period – This is the last day of your return period. For example, if you are paying for your the quarter covering April to June, you will add June 30 in your return period.

- Branch Code – What is the branch code that GCash is asking for? These are the numbers that come after your 9-digit TIN. For example, if your TIN says 123-456-789-000, your TIN is 123456789 and your branch code is 000. Having three zeroes means you are an individual (not a business with branches). GCash requires five digits for the branch code. So if you have three zeroes, just add 00000 there.

- To use this method, you must file your taxes first via the e-filing.

- It is recommended that you only use this method if you are paying for taxes no more than P10,000. For payments above this amount, I pay via a BIR-accredited bank. If paying by bank, bring three copies of your printed and filled out form together with the email confirmation you received from BIR after you filled out the form.

- It is important to keep all records of your payment by taking screenshots of your GCash confirmation screen and saving the confirmation email (just in case). I also print out the documents for safekeeping.

- Do you have specific tax-related questions? You can contact BIR via contact_us@bir.gov.ph. I’ve done this a couple of times and they are responsive.

How To Pay Your Taxes Using GCash

Note: This is a step by step guide on how I pay BIR using GCash. Please note that you can only do this for taxes that have not passed their due date. If your tax is past due, please go to the nearest BIR branch with your filled out form to get a recomputed tax due. A penalty fee will be added for taxes that are not filed and paid before the due date.

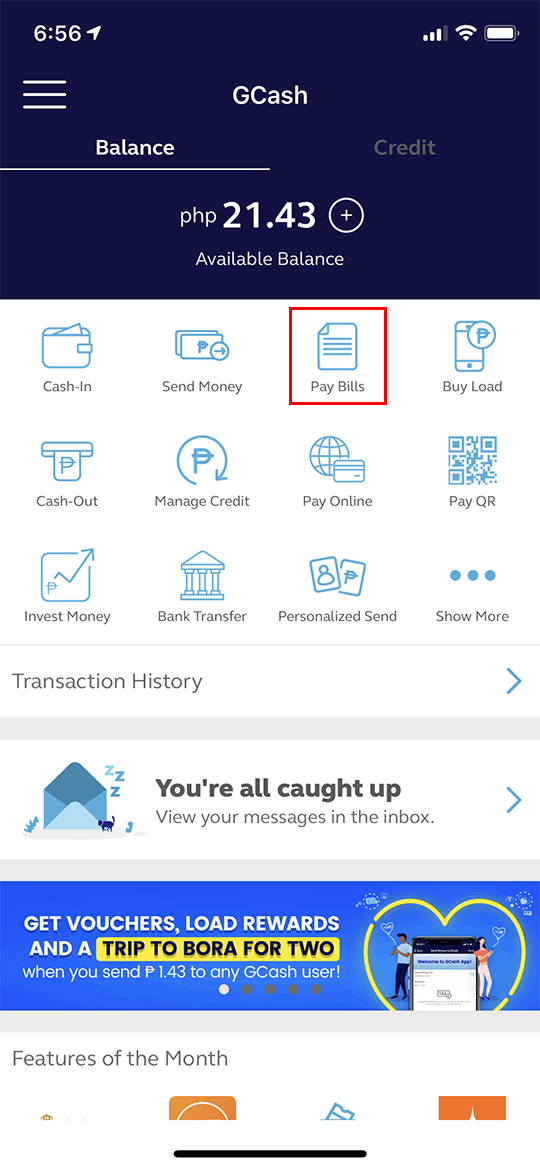

Step 1: Open the GCash app then select Pay Bills.

Step 2: From the options, select Government.

Step 3: From the list, select BIR.

Step 4: Under the Form Series selection, choose 2500 (Percentage Tax and VAT) if you’re going to pay for the quarterly Percentage Tax. Under Form Number, select 2551Q. Under Tax Type, select PT.

Of course, your selection will depend on what tax you’re paying. Click here to find the list of form series and form types.

Step 5: In the Return Period, select the last day of the quarter for which you’re paying for. For example, if you’re paying for the October-December 2018 return period, select December 31, 2018.

Step 6: Enter your TIN, Branch Code (just put 00000 if you don’t have any other branches), and the Amount.

If you want to receive a confirmation e-mail, add your e-mail address as well. I recommend that you do this so you have a record stored in your e-mail. You can also print that out if you wish.

Step 7: Confirm your payment. You will be directed to a payment confirmation page and receive a text message confirming your payment. I recommend taking a screenshot of the page and keeping the text message. These will serve as proof just in case BIR checks if you really paid your taxes.

That’s it! You successfully paid your tax through the GCash app and you saved yourself from hours of lining up at the bank.

If you still don’t have it, download the GCash App here. Aside from paying taxes, you can use it to pay your bills and use it as payment for your groceries, eat outs, and more.

IMPORTANT: Please pay BIR via GCash before your tax due date to prevent any penalties. For taxes that are past due, you will need to go to BIR first for a new computation (tax due + penalty). To avoid extra charges, make sure you are on schedule. Click here to view our tax schedules.